Safe Banking News

Safe Banking for Depositors and Investors to help you Secure Financial Safety

Discover, create and grow financial management with the safest banks and financial institutions.

Rated 5 stars by 10,000+ users

★★★★★

All: ▲ 33.3%

Average

+ $2,473.65

Performance

Quarter ?

Expenses

$123,456

Income

$654,321

Profit

+ $530,865

▲ 100% / 3

Percentage

Finances

Annual ?

Total: 100%

Overall: 33%

New: 99%

Goals: 100

Reached: 97

Todo: 3

Trusted by industry leaders:

What Are the Safest Banks to Deposit Your Money?

See why people trust our platform to stay in the know of what bankers don’t want you to know about the banking system.

Asset Quality Rating

The asset quality rating reflects the quantity of existing and potential credit risk associated with the loan and investment portfolios, other real estate owned, and other assets, as well as off-balance sheet transactions.

Capitalization Rating

Bank capital represents the value invested in the bank by its owners and/or investors. It is calculated as the sum of the bank’s assets minus the sum of the bank’s liabilities, or being equal to the bank’s equity.

The Liquidity Rating

Liquidity is the risk to a bank’s earnings and capital arising from its inability to timely meet obligations when they come due without incurring unacceptable losses. Bank management must ensure that sufficient funds are available at a reasonable cost to meet potential demands from both funds providers and borrowers.

Return on Assets

The term return on assets (ROA) refers to a financial ratio that indicates how profitable a company is in relation to its total assets. Corporate management, analysts, and investors can use ROA to determine how efficiently a company uses its assets to generate a profit.

CTA

What does SAFE mean in Banking?

Secure and Fair Enforcement (SAFE) Banking Act was first introduced to Congress in May 2017.

0% sign up or monthly fees.

100m

Annual profit

Only load what’s needed

300 +

5 star review

See all testimonials

33b

Average increase

Free to download

10k

Happy customers

Supports the latest

The US has the largest bank in the world with over 500 FDIC insurance firms. Banks and credit unions in the area have its advantages and most American citizens choose national banks best credit union to save time and money. The fact that banks have many different options can sometimes cause confusion, which operate much different than private money lenders.

How to verify which banks are safe for depositing your money?

To verify which banks are safe for depositing your money, consider the following steps:

The Best Bank is Chase bank as far as capitalization. It is a major bank and a top choice for national banks. You’re also given access to nearly four-seven retail outlets in the city. Like most national financial institutions though, their fixed interest rate amount is low, but their products are wide. Aside from bank bonuses, nobody can beat Chase bank at the current time so currently they’re wearing the crown as the best bank but mostly due to capitalization, not based upon risk ratio’s. The company regularly offers national signup bonuses to new customers. Chase has also been known for their welcome bonuses and numerous credit card programs it offers. US – Site By States

Best Banks Frequently Asked Questions

It varies by priority. If you like the experience with the brick and mortar banks, you want the convenience. Physical banking is also better for everyone with remittances that are regularly received. In a bank online a person may normally deposit money with a mobile device, but they are incapable of transferring money. However, online banking is usually more efficient for lower charges foreign transaction fees and APYs. As an online bank does not require physical branch locations, the online bank will be cheaper. This is not easy to say since personal banking needs vary between people. Chase has many locations and provides you with easy cash and great service. But the Bank of America has not been far behind when it comes to capitalization. Keep in mind when someone ask the question, “What is the best bank?” It can be several different answers because if you are referring to the best bank for checking and savings accounts the answer would be different, if you were asking for the best bank for fewer fees charged or the bank with fewer fees

Remember that no bank can guarantee absolute safety to deposit cash, but following these steps for minimum deposit amount can help you make a more informed decision when choosing where to deposit your money.

ALL

Reviews & Safest Banks Based On Financial Reporting →

Best Online Bank: Ally Bank

This online bank offers several banking products, from auto finance to investment. Among its key products are savings, checks, individual IRAs, certificates of the deposit accounts, or money markets accounts. It offers a minimum balance of 3.48% which is free of annual or any monthly maintenance fees, fee or charges or a no monthly fee and minimum balance of $1. However, the accounts offer transaction fees of over $120. The bank also says users can be charged for expedited shipment, international wire transfers, checking and return of money to their accounts.

What this bank offers

Allybank is an online-only banking with consistently high interest rates and many savings accounts, making it a top bank for saving money. Our products include an exceptional high yield savings account, and cash account and several savings accounts. For long-term plans there is a monthly fee-free account for retirement. All charges are no monthly maintenance fees. Online Saving Account allows you to create up to 100 different buckets and track your progress. This online savings account and checking account, also is unique in that it allows for automatic saving through functions such as Roundups and Surprise Savings.

How to get support

Ally does not have a physical branch in any way, but prefer online banking and offers 24/7 customer support. You can reach an experienced financial advisor via phone by calling 1-866-727-2489. It even has handy tools which estimate wait time when calling. There is a chat feature available to customers on the site or on mobile.

Top Online Banks

As of my knowledge cutoff in September 2021, the following online banks were considered some of the very best banks in the United States. Please note that rankings and offerings may have changed since then, and you should verify the current standings and account details before making any decisions. As you will see many online banks offer the same services as a brick and mortar banks and can out compete them with the yields offered on savings and checking accounts due to lower overhead cost.

- Ally Bank: Known for its competitive interest rates, no monthly maintenance fees, and excellent customer service, Ally Bank offers online savings, checking, money market accounts, and CDs.

- Discover Bank: Along with its well-known credit card offerings, Discover Bank provides online banking services with no monthly fees, including savings accounts, checking accounts, money market accounts, and CDs.

- Capital One 360: A part of Capital One, the 360 platform offers online banking with competitive interest rates, no monthly fees, and access to an extensive network of fee-free ATMs.

- Chime: A fintech company offering online banking services, Chime is known for its fee-free checking account, automatic savings features, and early access to direct deposit funds.

- Marcus by Goldman Sachs: Marcus is an online bank by Goldman Sachs that offers high-yield savings accounts, CDs, and personal loans. It is known for competitive interest rates and no monthly fees.

- Simple: Simple provides online banking services with budgeting and savings tools integrated into their platform. They offer a checking account with no monthly fees and various built-in features to help customers manage their money.

- SoFi Money: SoFi Money is a cash management account offered by SoFi, a fintech company known for its loan products. The account combines features of checking and savings accounts and offers competitive interest rates and fee-free access to ATMs.

- Varo Bank: Varo is a digital bank offering fee-free checking and high-yield savings accounts. They also provide early access to direct deposit funds and have a network of fee-free ATMs.

- Axos Bank: Axos Bank offers a range of online banking products, including checking accounts, savings accounts, money market accounts, and CDs. They are known for competitive interest rates and various account options tailored to specific customer needs. Axos bank is also known for competitive rates. You won’t find an Axos bank branch

Before choosing from many of the online banks, consider factors such as interest rates, fees, account features, ATM access, and customer service to find the best fit for your financial needs. Make sure you compare the high yield savings account with each competitor. They are very competitive for the best online bank account and don’t usually charge any annual fee on some of their best credit union and card offers. You get to decide what are the best banks for you based on your needs. So basically if your account is under $250,000 then you might care less about the risk of the bank defaulting since you’re insured by the FDIC. If this is your situation, then it could be very different for someone with $2,000,000 in the bank for an online high yield savings account. Now you can see the best banks definition could vary from customer to customer. I just want you to not be programmed to think that the best banks are the biggest banks. One of the biggest features of some of the online banks are that they will allow early direct deposit and this alone is worth it’s weight in gold to someone struggling with cash flow. After all who wouldn’t want an early direct deposit.

What are money market accounts and how do they work?

Money market accounts (MMAs) are a type of deposit account offered by banks and credit unions. They combine features of both a savings account and checking accounts, providing a higher interest rate than traditional savings accounts while still allowing for limited check-writing and debit card access. Here’s an overview of how a money market account works:

- Interest rates: MMAs generally offer higher interest rates than regular savings accounts. The interest rates on MMAs are variable and may change over time, often in line with market conditions. These higher interest rates are possible because banks and credit unions invest the deposited funds in short-term, low-risk securities like commercial paper, Treasury bills, and certificates of deposit (CDs).

- Minimum balance requirements: A money market account often have higher minimum balance requirements compared to regular savings or checking accounts. Failing to maintain the required minimum balance may result in lower interest rates or fees.

- Transaction limits: MMAs are subject to the same transaction limits as savings accounts under the Federal Reserve’s Regulation D. This means you are allowed up to six “convenient” transfers or withdrawals per statement cycle, which includes checks, debit card transactions, and electronic transfers. Exceeding this limit may result in fees or account restrictions.

- Access to funds: Although MMAs have transaction limits, they still offer more accessibility to your funds than certificates of deposit (CDs), which typically require you to leave your money untouched for a fixed term. With an MMA, you can access your money through checks, debit cards, ATMs, or electronic transfers, subject to the transaction limits.

- FDIC or NCUA insurance: Money market accounts at banks are insured by the Federal Deposit Insurance Corporation (FDIC), while those at credit unions are insured by the National Credit Union Administration (NCUA). This means that your deposits are protected up to $250,000 per depositor, per institution, in case the bank or credit union fails.

Money market accounts can be a good option for those who want to earn higher interest rates or a high yield savings account on their deposits while still maintaining some liquidity and access to their funds. However, it’s essential to consider the money market account’s fees, minimum balance requirements, and transaction limits when comparing MMAs with other types of deposit accounts. Many of these banks are great for online savings account and direct deposits.

Best in-person bank for CDs

ATM locations: US Bank currently serves more than 2,000 branch locations in 25 States, with more than 37,000 ATMs through MoneyPass. Why does the CD have an advantage in the money market account the United States? The Bank offers more types of CDs than most banks: these include Step up CDs increasing your rate each month, and Trade Up CDs increasing your rate once during a term. If your maintenance fee is waived monthly, the United States Bank is making it a little harder.

People know inherently that bankers want there money to make money for themselves, but feel their is no better option to put there money for accessibility and liquidity. Now is the time to transition to a new way of banking.

- “A bank is a place that will lend you money, if you can prove that you don’t need it.”

Banking Informant

2. “A banker is a fellow who lend his umbrella when the sun is shining and wants it back the minute it begins to rain.”

Banking Informant

3. “Banking is necessary, banks are not.”

Banking Informant

4. “Good banking is produced not by good laws, but by good bankers.”

Banking Informant

Safest Banks Aren’t the Largest Capital Banks

If you believe in too big to fail and that nothing can sink the Titanic Big Banks then you’re program to go with the masses and Risk all your money. Alternatives are private money lenders.

AMG National Trust Bank

A+ rating for safety of your money in the bank

17.40

⭐️⭐️⭐️⭐️⭐️

Risk Based Capital Ratio

11.38

⭐️⭐️⭐️⭐️⭐️

Leverage Ratio

2.13%

⭐️⭐️⭐️⭐️⭐️

Return On Assets

Bank of Alma

A+ rating for safety of your money in the bank

–

⭐️⭐️⭐️⭐️⭐️

Risk Based Capital Ratio

46.62

⭐️⭐️⭐️⭐️⭐️

Leverage Ratio

2.35%

⭐️⭐️⭐️⭐️⭐️

Return On Assets

Bank of Cleveland

A+ rating for safety of your money in the bank

26.03

⭐️⭐️⭐️⭐️⭐️

Risk Based Capital Ratio

16.19

⭐️⭐️⭐️⭐️⭐️

Leverage Ratio

1.79%

⭐️⭐️⭐️⭐️⭐️

Return On Assets

Bank of Prairie Du Sac

A+ rating for safety of your money in the bank

20.83

⭐️⭐️⭐️⭐️⭐️

Risk Based Capital Ratio

14.41

⭐️⭐️⭐️⭐️⭐️

Leverage Ratio

1.50%

⭐️⭐️⭐️⭐️⭐️

Return On Assets

Citizens Bank

A+ rating for safety of your money in the bank

–

⭐️⭐️⭐️⭐️⭐️

Risk Based Capital Ratio

18.46

⭐️⭐️⭐️⭐️⭐️

Leverage Ratio

2.31%

⭐️⭐️⭐️⭐️⭐️

Return On Assets

Cumberland Security Bank

A+ rating for safety of your money in the bank

19.18

⭐️⭐️⭐️⭐️⭐️

Risk Based Capital Ratio

12.86

⭐️⭐️⭐️⭐️⭐️

Leverage Ratio

2.53%

⭐️⭐️⭐️⭐️⭐️

Return On Assets

Esquire Bank, NA

A+ rating for safety of your money in the bank

15.44

⭐️⭐️⭐️⭐️⭐️

Risk Based Capital Ratio

10.98

⭐️⭐️⭐️⭐️⭐️

Leverage Ratio

2.55%

⭐️⭐️⭐️⭐️⭐️

Return On Assets

Farmers Trust & Savings Bank

A+ rating for safety of your money in the bank

25.75

⭐️⭐️⭐️⭐️⭐️

Risk Based Capital Ratio

19.47

⭐️⭐️⭐️⭐️⭐️

Leverage Ratio

1.75%

⭐️⭐️⭐️⭐️⭐️

Return On Assets

FDS Bank

A+ rating for safety of your money in the bank

71.63

⭐️⭐️⭐️⭐️⭐️

Risk Based Capital Ratio

41.88

⭐️⭐️⭐️⭐️⭐️

Leverage Ratio

756.15%

⭐️⭐️⭐️⭐️⭐️

Return On Assets

First Eagle Bank

A+ rating for safety of your money in the bank

–

⭐️⭐️⭐️⭐️⭐️

Risk Based Capital Ratio

19.08

⭐️⭐️⭐️⭐️⭐️

Leverage Ratio

2.48%

⭐️⭐️⭐️⭐️⭐️

Return On Assets

Real time analytics

Advanced tracking

Instant payouts

Usable data

Guaranteed returns

Easy to use platform

NFT collection

Smart banking

Crypto wallet

User collaboration

Best high-yield savings account

LendingClub is an online bank with a branch located in Cambridge, Massachusetts. Through the New York State ATM network, SUM or Money Pass, the company provides a network of over 325,000 surcharged cash-back ATMs around the world. What makes LendingClub unique? A company is probably the best choice for a person that values customer support. Customer care agents are available 24/7 via email or phone. What should be kept an eye on: LendingClub has no bank account. Even though its CD rates are solid, they are still better elsewhere.

Best for a large branch network

Chase has more than 4,700 branches in all the states of the United States and more than 1600 ATMs across the nation. Chase is based in over 100 states. The bank is also available for several kinds of savings and checking accounts, and there are benefits like relationship to pay higher interest rates and allowing for the opening of many banks. Chase is notably mentioned in our guide to the best three months CD prices, the best child savings and checking account and the best bank nationwide. What should be on my radar when I do not fulfill my monthly payment? You may also be charged when you use ATMs outside the network.

Finding the Best Banks in 2023

SmartAsset searched through all the different banking services throughout the country in a search for the best banking options for 2020. We picked the best banks, prefer online banking, and best credit union that make access to your bank, savings and checking accounts simple with low fees and with low interest rates, if necessary. Below, we list some of the best online financial institutions: banks, credit unions, student, and savings accounts.

Best for avoiding monthly fees

The Monthly service fees, fee minimum deposit, and monthly maintenance fee can be avoided if you do your research to find the best bank without these bank fees.

Region has around 1200 branches in 15 states. Around 2200 ATMs. It stands out out of network atm, in the world of regional banks because they have an enormous variety. Region’s LifeGreen® Saving Account offers an alternative to brick-and-mortar banking. The company charges no monthly fee and has no deductibles. What is the local fee for use of an ATM outside the network or if you use it? Depending on your account the same no or monthly service fee or fees or fee or fees they charge will apply.

ATM Network

Why choose Varo? The company has a good balance of competitive interest rates with a low cost of ownership and handy savings software. Varo savings accounts earn yearly percentage yields of three % of APY without monthly fees and up to five % of APY charge monthly fees by satisfying specific needs each month. The savings account also saves your payments by automatically sending out a percentage of your earnings or other direct deposits and saves changes to the account.

Mobile app

It’s a huge issue nowadays. The right bank’s mobile app will make a better bank and can be very helpful in managing a bank account. Contact our Bank mobile app for more information. We also recommend you to look at some good and bad reviews in the App store.

Best online checking account

Branches: Though Capital One360 is considered a virtual bank the institution does have a few physical offices. The company has more than 300 branches located across 7 states, and 50 Capital One Cafes, where people can grab Peet’s coffee, speak to money coaches or open bank accounts. The network includes more than 40,000 ATM machines available on the Capital One or Allpoint network. Capital One 360 checks are recognized for being our most popular bank. There’s no over drawable foreign transaction fee and one is not required to make a minimum deposit. The bank has topped the list of most satisfied consumers in US Bankers Surveys.

How to verify which credit unions are safe for depositing your money?

To verify which credit unions are safe for depositing your money, consider the following steps:

- NCUA insurance: Make sure the credit union is insured by the National Credit Union Administration (NCUA). The NCUA provides insurance coverage for your deposits up to $250,000 per depositor, per institution, in case the credit union fails. You can verify if a credit union is federally insured by using the NCUA’s Research a Credit Union tool: https://mapping.ncua.gov/ResearchCreditUnion.aspx

- Financial health: Research the credit union’s financial health and stability. Look for financial performance reports, credit ratings, or financial assessments from third-party sources. A healthy credit union will have sufficient reserves, a strong capital position, and positive earnings.

- Regulatory compliance: Ensure the credit union is in good standing with regulatory authorities like the NCUA and the Consumer Financial Protection Bureau (CFPB). Credit unions that are regularly fined or penalized for regulatory violations may not be the best choice.

- Capital adequacy: Credit unions with higher net worth ratios are better equipped to handle economic downturns or financial crises. The net worth ratio is a commonly used metric to assess a credit union’s financial strength. Higher ratios indicate a more financially stable institution.

- Transparency: Choose credit unions that are transparent about their fees, interest rates, and terms and conditions. This helps you make informed decisions and avoid unexpected costs.

- Customer service: Consider the credit union’s reputation for customer service. A credit union with responsive and helpful customer service will likely be more reliable and trustworthy.

- Online presence: Evaluate the credit union’s online presence and digital banking capabilities. A strong online and mobile banking platform can make it easier to manage your accounts and access your money.

- Reviews and recommendations: Check reviews and recommendations from other members, consumer protection agencies, and financial publications to gauge the credit union’s overall reputation and performance.

By following these steps, you can make a more informed decision when choosing a safe credit union for depositing your money.

What this credit union offers

You never expected us to include any credit union to this list. The surprises are huge! Alliant Credit Union does not exist. This digital credit union features an impressive assortment from high yield checking account and savings accounts, to credit cards, and loans. Those two accounts pay very high interest rates and the higher rate savings account has no minimum. the Alliant credit union charges no monthly fees on most of its deposits. Although a few minimum deposit requirements can be made they are small, like $50 per deposit in savings interest checking accounts only. In credit union terms, the Alliant credit union offers a great deal of flexibility and a very affordable cost.

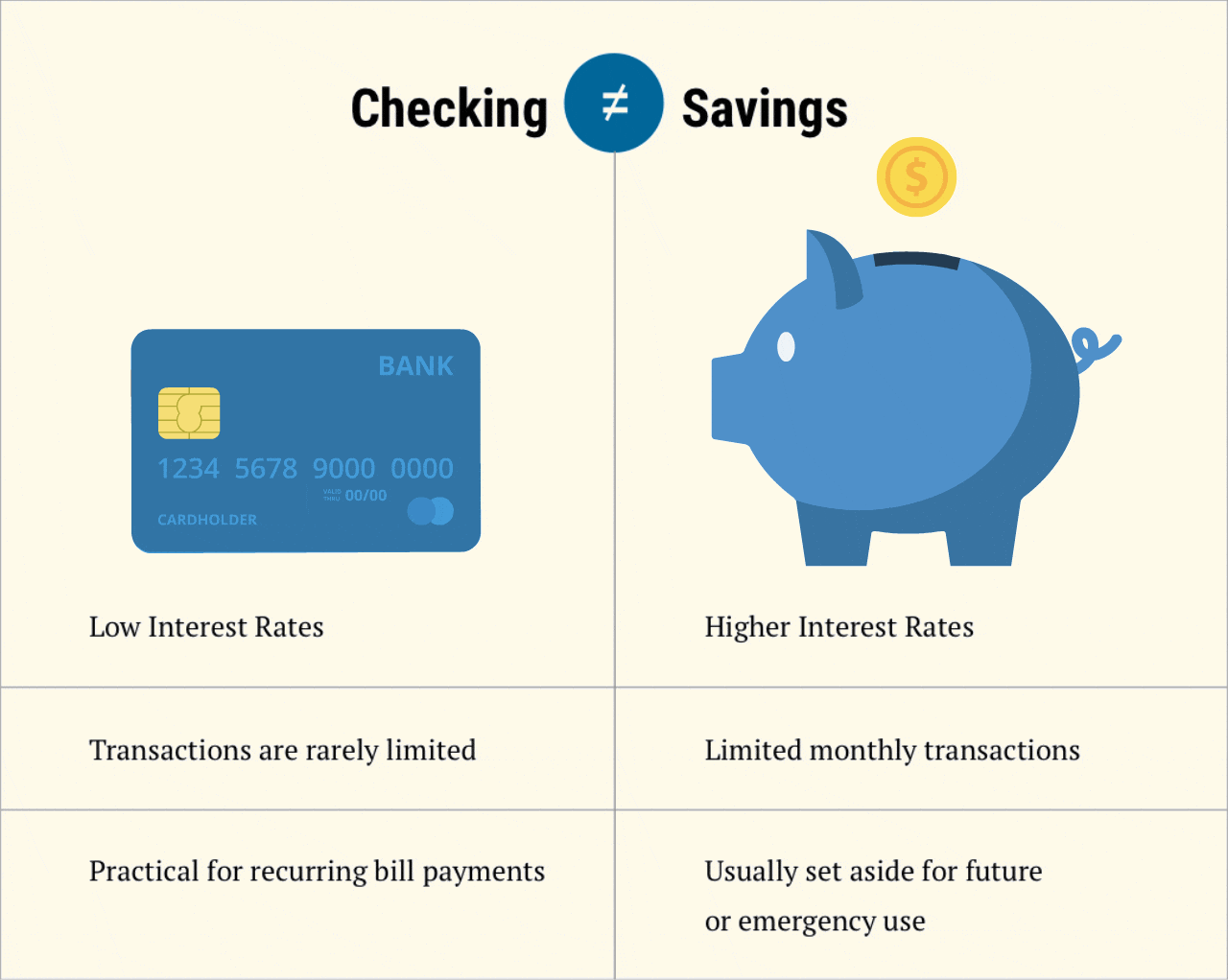

Savings Accounts

Savings accounts are deposits you can make and earn money by putting your money into. Saving account withdrawals may be limited to monthly deposits and may incur monthly maintenance fees. Normally you can set up savings accounts for things you don’t require to use regularly. How do I find an ideal 401k account for a low interest rate?

Customer satisfaction

Customers are satisfied and in a world where they are able to choose. This will help you quickly find out if banks generally maintain their customer base. Is there a better way in which to get a quick overview out of network atm customer satisfaction in a bank?

Which is better, an online bank or a brick-and-mortar bank?

It depends on the bank experience that is important. For people whose cash deposit is a daily requirement they need a local brick and mortar bank, where there are convenient bank locations near you. Online banks have a different overhead from a physical location but brick and mortar banks typically have sufficient funds available to transfer online savings account to you. Online banking was a good platform for your online or mobile experience in the past, but this is no longer the case. Banks big brick and mortar banks small are confident that your everyday banking experience will remain simple.

What is an online only bank?

An online-only bank or online banking without any physical branches, also known as a digital bank or internet bank, is a financial institution that operates exclusively through digital channels without any physical branches. These online banks offer a range of banking services, such as checking and savings accounts, personal loans and, and investment products, all accessible through online platforms or mobile apps.

Here are some key features of online-only banks:

- No physical branches: Online-only banks operate without brick-and-mortar locations, which means all transactions and interactions with the bank occur online, via mobile apps, or through phone support.

- Lower fees and higher interest rates: Due to lower operational costs from not maintaining physical branches, online-only banks often pass the savings to their customers in the form of lower fees and higher interest rates on deposit accounts.

- 24/7 access: Customers can access their accounts, conduct transactions, and manage their finances anytime, anywhere, as long as they have an internet connection.

- Digital features: Online-only banks typically offer a range of digital features and tools, such as mobile check deposit, bill payment services, budgeting tools, and real-time transaction alerts.

- ATM access: Although online-only banks do not have their own ATMs, they often partner with ATM networks to provide their customers with access to thousands of surcharge-free ATMs nationwide.

- Customer support: Online-only banks generally offer customer support through phone, email, live chat, or social media channels. However, the lack of in-person support may be a drawback for customers who prefer face-to-face interactions.

- FDIC or NCUA insurance: Many online-only banks are FDIC-insured, while online-only credit unions are NCUA-insured, meaning your deposits are protected up to $250,000 per depositor, per institution, in case the bank or credit union fails.

Online-only banks can be an attractive option for customers who prioritize convenience, lower fees early direct deposit only, and higher interest rates, and do not require physical branches for their banking needs. However, it is essential to research the online-only bank’s reputation, security measures minimum deposit amount, minimum deposit requirements foreign transaction fees, and customer service before opening an account.

Branch and ATM footprint

This may not matter if you do not use an internet banking service but you can learn about the options a person can take should you need one. In these categories the large financial institutions are generally the dominant players. It has many branches spread across the nation, so you may have in-person support whenever something goes wrong. Digital banks rarely have branch locations but they often make up large ATMs, so you have plenty of choice. Again, no dealbreaker, but our study focused on banks having heavy footprints at branch or ATM sites.

How much interest do the best big banks pay?

The current savings rate in the US is 0.21% and even lower on no interest checking accounts: 0.3%. There are exceptions. Citi® Accelerate Savings offers an annual fee of 3.85%. But generally, unless you seek direct deposits with national banks with higher rates, your search high yield savings, will be most successful if you concentrate on national online banks like Discover, Capital One, CIT, or ALLY.

Competitive interest rates

Today, having competitive rates for your banking services is essential. We sought out banks offering good rates on products. You should not be afraid of considering making this a priority while searching.

Checking Accounts

A checking account is the easiest method of deposit cash regularly making payments online, using credit card or bank or debit card purchases. In many cases, bank accounts are connected to their checking accounts for protection against overdrafts. Certain bank accounts can earn interest if you deposit cash regularly make a purchase using interest checking out, though this may be an exception rather than a rule.

Types of Bank Accounts

Depending on your banking history, you have five different checking accounts and may have a money market account or accounts only understand savings accounts. However bank accounts offer different types giving citizens bank and the consumers the flexibility to save, spend and spend. This is the most commonly used bank account.

Credit Cards

Credit and debit card purchases and payments are an efficient way to purchase products. Some provide rewards like money back rewards, points and miles. Some online banking services may also offer credit cards. The rewards structure, annual percentage rates and fees can help you compare credit and debit card purchases and offers.

Services Offered by Banks

The safe banking of service offered by different banks. The bank generally provides a broader range of services than the rest of the traditional banks. Below are the various safe banking services offered by the bank.

How long does it take to open a bank account?

Creating a banking online bank account options is easy and takes just 10 minutes to set up. Opening a bank account online can take a few days if a bank is required to provide copies of identification. The speed at which the user can open his or her own new bank account options varies from a few minutes up to multiple days.

Overdraft fees

Chase bank, Bank of America and Wells Fargo are the worst offenders.

Overdraft fees are a common banking charge that customers may encounter when they withdraw more money from their account than is available, resulting in a negative balance in checking account. These fees can quickly add up and create financial strain for account holders. Banks impose overdraft fees as a penalty for insufficient funds and as a way to compensate for the risk of extending a short-term loan to the customer.

In some cases, overdraft fees can be quite high, and multiple instances of overdrafts can lead to a significant financial burden. It is essential for consumers to be aware of their bank’s overdraft fee policies and take steps to avoid them. Some banks offer overdraft protection services, which can help reduce the likelihood of incurring overdraft fees. These services may link a customer’s checking account to a savings account or a line of credit, automatically transferring funds to cover any overdrafts. While this can help avoid overdraft fees, it is important to note that some banks may charge a fee for using overdraft protection services, albeit generally lower than standard overdraft fees.

Many banks have faced criticism for their overdraft fee practices, with consumer advocates arguing that excessive overdraft fees disproportionately impact low-income customers. In response, some banks have modified their policies, reducing overdraft fees or providing more lenient terms for customers. It is crucial for consumers to compare banks’ overdraft fee policies and choose an institution that offers fair and transparent terms. By carefully managing their accounts, setting up low balance alerts, and considering overdraft protection options, customers can minimize the impact of overdraft fees on their financial well-being.

Best Banks for Minimum Deposits

Finding the best bank for minimum deposits depends on your financial needs and preferences. Some banks offer accounts with low or no minimum deposit requirements, which can be particularly helpful for those looking to start with a smaller balance. Here are a few banks that provide accounts with low or no minimum deposit requirements, based on my knowledge up to September 2022:

- Ally Bank: Ally offers an Interest Checking account and an Online Savings account with no minimum deposit requirements and no monthly maintenance fees.

- Capital One 360: With no minimum deposit requirements or monthly fees, Capital One 360 offers Checking, Savings, and Money Market accounts.

- Discover Bank: Discover’s Online Savings and Cashback Debit Checking accounts require no minimum deposit and have no monthly fees.

- Chime: As a fintech company, Chime offers a fee-free Checking account (Spending Account) with no minimum deposit.

- Varo Bank: Varo provides fee-free Checking and Savings accounts with no minimum deposits.

- SoFi Money: SoFi Money’s cash management account combines the features of checking and savings accounts, and it requires no minimum deposit or monthly fees.

- Marcus by Goldman Sachs: The high-yield savings account from Marcus requires no minimum deposit and has no monthly fees.

- Axos Bank: Axos Bank’s Essential Checking account and High Yield Savings account both have no minimum deposit requirements and no monthly fees.

Before choosing a bank, consider factors such as interest rates, fees, account features, ATM access, and customer service to find the best fit for your financial needs. Remember to verify the current standings and account details, as these may have changed since September 2021.

SALE

Pricing for teams of all sizes

Personal

Save 50% $79

$39/yr

- Smart platform

- Unlimited analytics

- Custom branding

- NFT collections

- Real time tracking

- Live monitoring

- Instant payouts

Business

Save 50% $299

$149/yr

- Smart platform

- Unlimited analytics

- Custom branding

- NFT collections

- Real time tracking

- Live monitoring

- Instant payouts

Lifetime

Save 50% $599

$299/one time

- Smart platform

- Unlimited analytics

- Custom branding

- NFT collections

- Real time tracking

- Live monitoring

- Instant payouts

Personal

Save 50% $79

$49/yr

- Smart platform

- Unlimited analytics

- Custom branding

- NFT collections

- Real time tracking

- Live monitoring

- Instant payouts

Business

Save 50% $299

$199/yr

- Smart platform

- Unlimited analytics

- Custom branding

- NFT collections

- Real time tracking

- Live monitoring

- Instant payouts

Lifetime

Save 50% $599

$399/one time

- Smart platform

- Unlimited analytics

- Custom branding

- NFT collections

- Real time tracking

- Live monitoring

- Instant payouts

Questions You Should Asked Or Research Before Putting Your Money In A Bank

How do I create an accordion block?

How to use the icon block?

How do I create an accordion block?

How to submit a support request?

Will you consider adding this feature?

How do I create an accordion block?

How to use the icon block?

How to submit a support request?

Will you consider adding this feature?

How to use the icon block?

Have another question? Talk to our friendly support team →